Inside:

- Jury returns guilty verdict in Madigan corruption trial

- State’s corporate tax payments decline ahead of budget address

- Some new bills filed this spring

- Free showing of Glory at the Orpheum Theatre tomorrow night

Jury returns guilty verdict in Madigan corruption trial

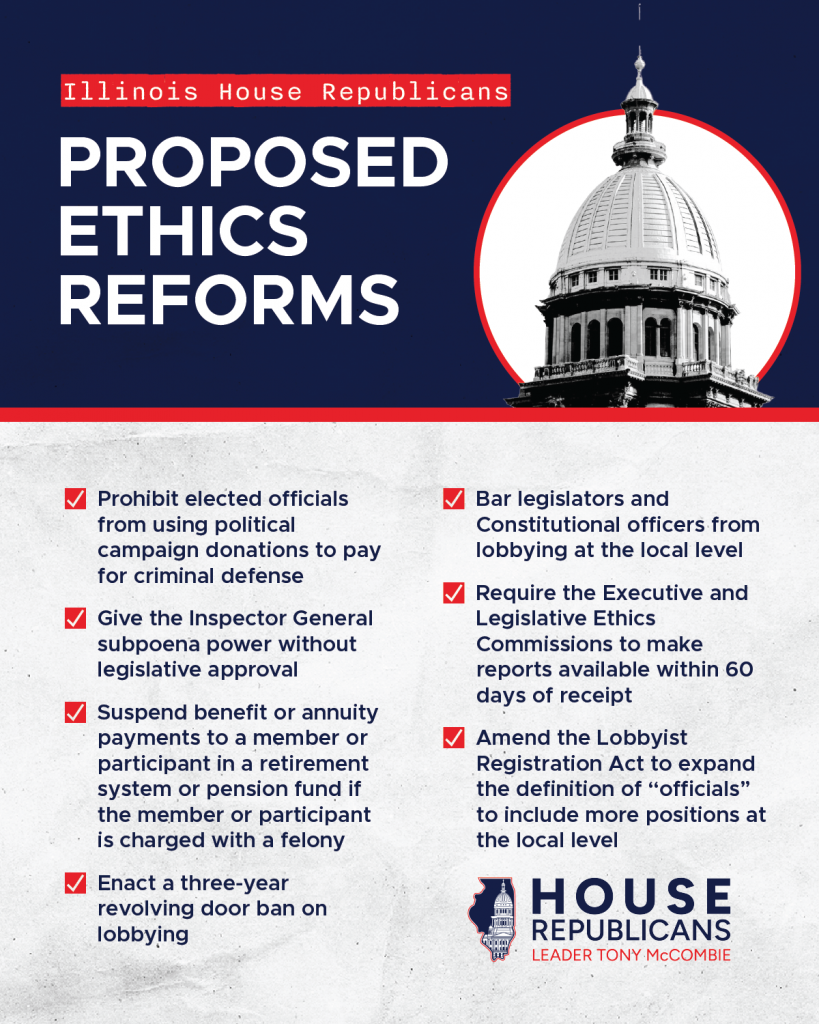

I was relieved to learn that former Illinois House Speaker Michael Madigan was found guilty by a federal jury in his corruption trial in Chicago. Madigan was accused of trading legislation for favors from powerful special interest groups.

The wiretaps and other evidence presented by prosecutors at the trial painted a picture of almost unfathomable levels of corruption and special interest wheeling-and-dealing, with Madigan and his associates profiting, while Illinois taxpayers paid the price. I am thankful for the investigators and prosecutors who spent years putting this case together and who finally brought Madigan to justice.

Michael Madigan ruled as one of the most powerful politicians in Illinois history. For 35 years he was the Speaker of the House, exercising his vast power to reward friends and punish opponents, with little regard for the well-being of the people of the state. Now that he has been convicted, we need to get serious about passing true ethics reform to rid state government of his system and start cleaning up the mess in Springfield.

State’s corporate tax payments decline ahead of budget address

Illinois’ corporate income tax receipts fell by 42% over the past year, a decline of $145 million to the state treasury. State sales tax receipts also fell in January by $4 million compared to one year earlier. These are more signs of trouble for the Illinois economy.

Taxes from electronic sports gambling went up by $28 million, but they were not enough to overcome an overall decline in money coming into the state treasury last month.

The state’s fiscal and budget watchdog agency, the Commission on Government Forecasting and Accountability, warned in its latest monthly report to the General Assembly that they do not see reassuring signs that the state’s financial picture will improve much this year.

Illinois is already facing a $3.2 billion budget deficit for the upcoming fiscal year and was only able to balance the current year’s record-high levels of spending by raising taxes by nearly $1 billion. State spending has gone up from $40 billion in 2020 to over $53 billion this year. We cannot keep this up.

The Governor will deliver his State of the State and Budget Address next Wednesday.

Some new bills filed this spring

Last Friday was the deadline for introducing bills in the House for this spring’s session. I filed several pieces of legislation which I am looking forward to presenting in committee and on the House floor.

House Bill 1149 creates the Educational Credit for Firefighting Experience Act. It would require all higher education institutions in Illinois to develop a policy about awarding academic credit for firefighter training that is applicable to the requirements of a student’s certificate or degree program. The legislation would apply to any student at the school who completed a firefighting training course or program that meets certain requirements.

Another bill I filed this spring is House Bill 1754, better known as the TICK Act (Tracking Infectious Cases Knowledgeably). The bill would get information about alpha-gal syndrome and Lyme disease to the Department of Public Health and the local health department on the date of the diagnosis. It will also get more information into the hands of the public about alpha-gal syndrome and Lyme disease within individual counties – and will do so much quicker. This will help raise awareness of the presence of these illnesses in local areas and help residents take preventive measures.

A third bill I am sponsoring is House Bill 3017, which will help the spouses of military personnel living in Illinois. When military personnel are assigned to new posts, it can create difficulty for their family members who must move to a new community and find a new job. This legislation creates a $5000 tax credit for employers who hire military spouses. It will encourage hiring and make the transition easier for the spouse of a member of the military who is new to our state.

You can see my full list of sponsored and co-sponsored bills here.

Free showing of Glory at the Orpheum Theatre tomorrow night

Tomorrow night at 7 p.m. in Galesburg there will be a free showing of the 1989 Civil War classic film Glory to help raise awareness of twelve heroes from Galesburg who fought for freedom with the 54th Massachusetts, the regiment depicted in the film.

I was proud to present a resolution in the House last fall honoring these twelve soldiers, two of whom were wounded at the battle of Fort Wagner, which appears in the climax of the film.

Thanks to the United Way of Knox County for making the free showing possible. The purpose of the event tomorrow is to promote the initiative of creating a permanent monument to honor these Galesburg soldiers who fought with the 54th. Thanks also to Mayor Peter Schwartzman, City Councilman Dwight White, Jim Jacobs and Pastor Tony Franklin who came to Springfield for the presentation about the Galesburg soldiers. The history of the 12 was compiled by the late Dr. Hermann Muelder of Knox College for his book A Hero Home From The War.

More news

U.S. Department of Justice lawsuit against Illinois involves immigration

State of Illinois offering tuition-free court reporting training program in Urbana, Wheaton

Using new technology to restore pieces of military history at the Rock Island Arsenal

From his presidency to his assassination Lincoln’s ledger open to public in Springfield